- AD150

- Posts

- Analyzing 1800 Cardiologists & 20 Newsletters | What Gets Cardiologists to Open & Click ?

Analyzing 1800 Cardiologists & 20 Newsletters | What Gets Cardiologists to Open & Click ?

Clinically relevant, ROI-driven, and ready to scale—here’s what moves this high-value cohort.

Good morning, ! This week we’re analyzing what get’s our 1800 weekly cardiologist readers in our Healthcare 150 publication to to open and click!

After analyzing 20+ subject lines and thousands of performance data points from our healthcare newsletter. More in the Audience Data Dive below!

In other news, we're spotlighting Shopify’s new B2B tools that are transforming enterprise commerce. We also share why LinkedIn founder-led videos and carousel ads are crushing engagement and doubling leads, plus how podcast ad spend is booming but still has room to grow.

Join 60+ advertisers who reach our 500,000 executives: Start Here.

Know another marketer who’d love this? Pass it along—they’ll thank you later! Here’s the link.

AUDIENCE DATA DIVE

What Gets Cardiologists to Click

After analyzing 20+ subject lines and over thousands data points from our healthcare newsletter, one trend is clear:

Cardiology audiences gravitate toward clinical relevance, care delivery shifts, and large-scale innovation — but only when tied to action and economics.

What Drives Performance

Top-performing subject lines in the cardiology cohort shared three core traits:

Procedural or setting transformation — outpatient shifts, surgery models, home care

Tech with immediate clinical utility — robotics, wearables, AI with patient impact

Clear ROI or financial tension — who’s funding what, and why it matters now

High-Performing Examples:

“Ambulatory Surgery: why PE, payers, and patients love lean care.” — 81.91% open rate

“Sports Medicine Goes Mainstream, and Profitable” — 84.41% open rate

“Healthcare CFOs: is spending big the only fix?” — 84.70% open rate

“Healthcare Robotics Hits $21B: PE Pivots to Platforms…” — 81.33% open rate

“Why AI in Healthcare Isn’t Experimental Anymore” — 80.17% open rate

What they all have in common: relevance, cost dynamics, and a changing care model.

What Themes Work Best

1. Care Delivery Shifts

Highest average open rates across the cohort. Works best when tied to surgical models, home-based care, or new sites of service.

→ “Ambulatory Surgery…” and “From Clinics to Couches…” led with >78% open rates.

2. Investment & M&A Trends in Cardio or Adjacent Markets

Perform well when capital is visible and macro-level demand is understood.

→ “Healthcare Robotics Hits $21B…” and “$1.25T by 2029…” both topped 80% open.

3. Tech & AI with Clinical Application

Delivers when positioned as applied, not theoretical.

→ “AI Isn’t Experimental Anymore” hit 80.17%; but vague tech posts underperformed (47–57%).

4. Niche Vertical Focus (Sports, Home Health)

Can outperform when paired with economic upside or unmet need.

→ “Sports Medicine Goes Mainstream…” drove one of the highest rates: 84.41%.

The Takeaway

To win with cardiology audiences, don’t just report innovation — translate it. Show how it affects delivery models, reimbursement, or financial decisions.

What works:

Lean procedural models (ASC, home, outpatient)

Tech with tangible care benefits

Clinical verticals with upside (sports, surgery, robotics)

Cost or capital shifts that affect practice economics

Skip the fluff. Deliver what’s new, why it matters, and who’s moving first.

AD INTEL

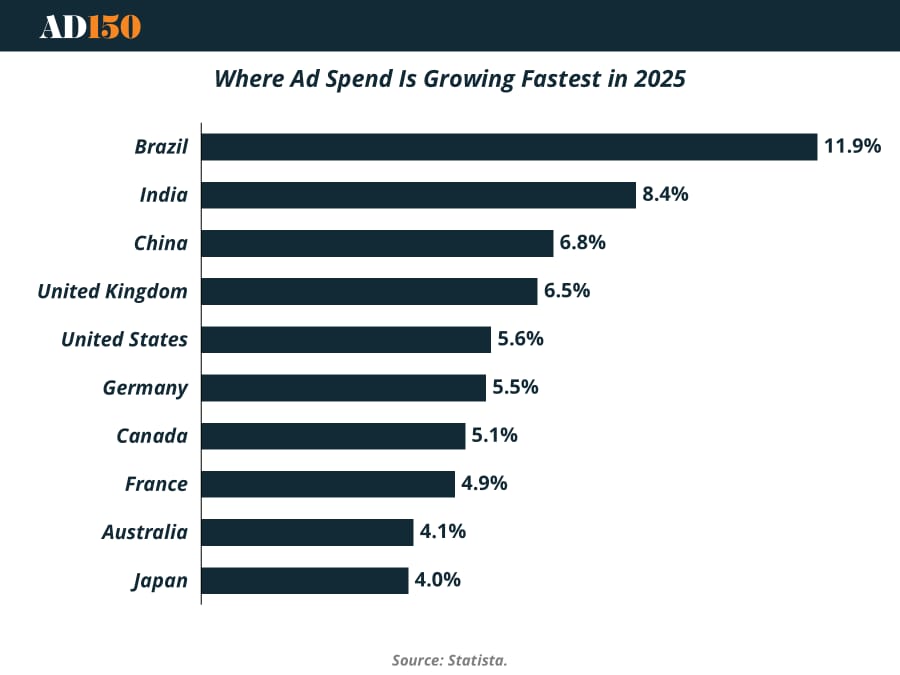

Brazil and India Lead Global Ad Market Growth in 2025

New forecasts show global advertising markets are gaining momentum in 2025, with Brazil and India emerging as the fastest-growing players. Brazil is expected to grow 11.9% year-over-year, followed by India at 8.4%, outpacing more mature markets as digital adoption and mobile-first strategies accelerate in both regions.

The U.S. remains the largest advertising market globally at $404.7 billion, growing a steady 5.6%, while China follows at $211.6 billion with a 6.8% increase. The U.K. rounds out the top three in growth rate with 6.5%, driven by performance media, programmatic expansion, and renewed post-Brexit investment.

The shift highlights how advertisers are looking beyond size to target momentum markets where rising middle classes, ecommerce penetration, and mobile usage are reshaping the media landscape. Mature markets like Japan and Australia remain stable but are growing more slowly, at 4.0% and 4.1% respectively.

To stay ahead, brands must tailor go-to-market strategies by region—balancing reliable spend in North America and Europe with agile, fast-growth plays in emerging economies. (More)

THE FUNNEL REPORT

Shopify’s B2B Partner Solutions Empower Enterprise Commerce

In 2025, Shopify launched four new B2B partner solutions to deliver enterprise-grade digital commerce for manufacturers, distributors, and wholesalers. Building on Shopify’s native B2B product, these tools enable brands to create quick-to-launch, cost-effective buying experiences tailored to complex B2B needs.

Two key storefront apps:

AAXIS Streamline: a Shopify native app for manufacturers and distributors with advanced approval workflows, custom shopping lists, and organizational management, enabling digital channel launches in 8–12 weeks.

Teifi Parts Accelerator: designed for OEM and aftermarket parts providers, featuring branded search, fitment validation, and saveable profiles, boosting discovery and conversions.

These apps complement Shopify B2B’s core features—custom company profiles, unique pricing, net terms, and B2B checkout—all integrated within Shopify Plus. This lets brands manage wholesale and direct-to-consumer sales on one platform.

By providing tailored tools and streamlined digital journeys from personalized storefronts to approval workflows, Shopify supports the full funnel from awareness to purchase, showcasing how tech boosts B2B demand generation and conversion. (More)

BUDGET SHIFTS

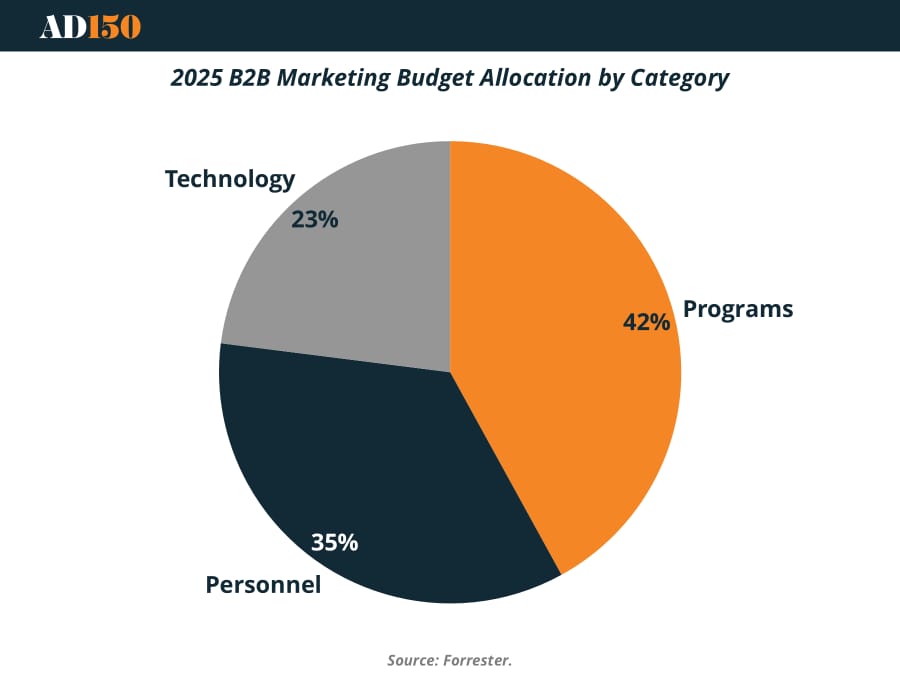

B2B Marketers Prioritize Programs Over Tech in 2025

New Forrester data shows how B2B marketers are allocating their budgets in 2025—and the emphasis is clear: Marketing Programs will receive the largest share at 42%, followed by Personnel (35%) and Technology (23%).

The distribution points to a shift away from infrastructure-heavy strategies and toward campaign execution and team enablement. Instead of building complex stacks, marketers are investing directly in initiatives that drive results—like programmatic, paid social, and content.

Meanwhile, continued spend on headcount reflects a growing belief that in-house speed and control are critical to marketing success. The lower share for tech doesn't signal disinterest—it suggests tools are being embedded within broader program strategies rather than standing alone.

In 2025, it’s not just how much you spend—it’s how quickly and effectively that spend hits the market. (More)

BUYER’S ROOM

Podcast & Audio Ads Gain Ground in 2025

Media buyers are rediscovering audio—stepping up investment as improved tools bridge the gap between listener engagement and measurable ROI. In June 2025, Westwood One’s Advertiser Perceptions study reported an all-time high in podcast spending intent—and more buyers are listening than ever.

Podcast ad revenue in the U.S. climbed to $2.4 billion in 2024, up 26.4% year-over-year from $1.9 billion in 2023

Although digital audio accounts for 20% of consumers’ time, it only captures about 2.9% of digital ad spend—approximately $7.6 b out of $258.6 b

The same IAB MMM guide reveals this mismatch—the classic “purchase attention vs. spend” imbalance—is only now being addressed through better measurement frameworks.

What buyers are doing:

Doubling down on audio as new MMM-aligned metrics prove impact—brand lift, attention, and conversion are now measurable.

Using IAB’s June 2025 Measuring Digital Audio in Media Mix Models guide to integrate audio into cross-channel planning

Rebalancing budgets to reflect consumption: 20% of audience time should attract more than 3% of spend.

“Podcast advertising has gone from experimental to essential” says Pierre Bouvard, Chief Insights Officer at Cumulus Media | Westwood One. “But despite the growth in participation, investment levels remain low relative to the opportunity.” (More)

CREATIVE THAT CONVERTS

Real Voices, Real Results: Why LinkedIn Video Ads With Founders Outperform

In today’s crowded B2B landscape, audiences don’t want polish—they want people. New LinkedIn data from over 13,000 campaigns shows that video ads featuring real executives or founders talking directly to the camera outperform traditional product-centric creative by a wide margin.

According to LinkedIn’s own benchmark study, founder-led video ads drove:

+129% higher engagement

+78% better view-through rates

+45% more downstream actions (clicks, form fills)

Why it works: These videos blend authenticity with authority. When a CEO or subject-matter expert breaks down a pain point in their own words, it signals credibility and builds trust—fast. (More)

CASE STUDY

Carousel Ads Double Lead Volume on LinkedIn

A recent 4-week campaign from Corporate Visions used carousel ads to engage sales and marketing leaders, driving a significant lift in performance across key funnel metrics. The campaign generated a 116% year-over-year increase in marketing-qualified leads and delivered 2× ROI compared to prior efforts.

The campaign strategy focused on delivering snackable, value-driven insights across multiple cards—each designed to educate, not sell. Audience targeting was refined using LinkedIn’s demographic filters and conversion tracking, allowing for real-time creative adjustments throughout the campaign window.

This case underscores the power of smart formatting, precise targeting, and iterative optimization in paid social. It offers a compelling example of how thoughtful creative and data-backed decisions can unlock better returns from platform-native formats. (More)

INTERESTING ARTICLES

"In the middle of every difficulty lies opportunity."

Albert Einstein