- AD150

- Posts

- The B2B Shift: Where Marketers Are Actually Winning in 2025

The B2B Shift: Where Marketers Are Actually Winning in 2025

B2B marketing is evolving fast—budgets chase new business, LinkedIn leads engagement, and personalization drives real sales growth. The winners of 2025 move with precision.

Good morning, ! This week we’re tracking the forces reshaping B2B marketing performance—from personalization driving measurable sales growth to LinkedIn’s rise as the non-negotiable channel for lead generation and buyer trust. We break down how brands are reallocating budgets toward new business, where high-intent audiences like Corporate Development deliver unmatched engagement, and what Slack’s storytelling campaign reveals about connecting with enterprise buyers through authenticity and scale. Plus, a look at TV ad consolidation around trust-driven industries and why creative relevance is emerging as the real conversion driver in 2025.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know another marketer who’d love this? Pass it along—they’ll thank you later! Here’s the link.

AUDIENCE DATA DIVE

Inside Corporate Dev’s Inbox

If subject lines reveal reader intent, Corporate Development offers one of the clearest — and most valuable — signals for advertisers in our Private Equity ecosystem.

Analyzing engagement across 40+ newsletters and thousands of subscribers, this audience shows a measured, high-intent reading pattern that consistently translates into results for brands. They don’t open everything — but when a story aligns with their focus on capital strategy and deal movement, engagement rises sharply.

Average open rates hover around 40%, and when the content connects to real capital movement, performance spikes big.

For advertisers, that behavior signals precision — attention that activates when decision-makers are looking for signals that shape strategy, allocation, and growth. It’s not casual readership; it’s informed attention that creates meaningful context for brands positioned alongside it.

What Captures Their Attention

Capital in Motion

Liquidity cycles, fund shifts, and reallocation trends drive the sharpest engagement.

These readers open when money moves, not when markets idle.

→ “$6.4B Exit & $3T Credit Surge” → 86.08% open rate

What it means for brands: campaigns aligned with market momentum (analytics, finance tools, data providers) naturally earn higher CTRs and deeper credibility.

Deal-Making Dynamics

M&A headlines tied to transaction scale or GP-led structures consistently outperform.

→ “PE’s $285B Add-On Wave Meets GP-Led Shift” → 46.15% open rate

What it means for brands: ads placed in this context benefit from trust transfer — they appear next to content that decision-makers are actively benchmarking against.

Macro Turns

Growth slowdowns, liquidity crunches, and market resets all pull Corporate Dev readers back in.

→ “PE’s New Math: Why 4.2% Earnings Growth Is the Bar” → 67% open rate

What it means for brands: these are inflection points — moments when strategy is being re-evaluated and budgets are being reallocated.

Why It Matters for Advertisers

High open rates here don’t just mean visibility — they represent timing, trust, and context.

Corporate Dev readers engage when headlines help them make sense of capital markets — that’s when brand messages land with maximum relevance.

For advertisers, that means your campaigns:

Reach decision-makers in moments of active strategic reflection.

Earn halo credibility by appearing alongside performance-driving content.

Capture intent-driven attention that translates to higher recall and stronger lead quality.

Going Forward

Lead with the signal — show movement, not noise.

Quantify the moment — numbers build credibility.

Tie it to timing — why it matters now.

Corporate Dev readers may not open everything, but when they do, they’re reading for action.

That’s where brand relevance becomes measurable performance.

AD INTEL

Entertainment and Pharma Dominate TV Ad Impressions in 2025

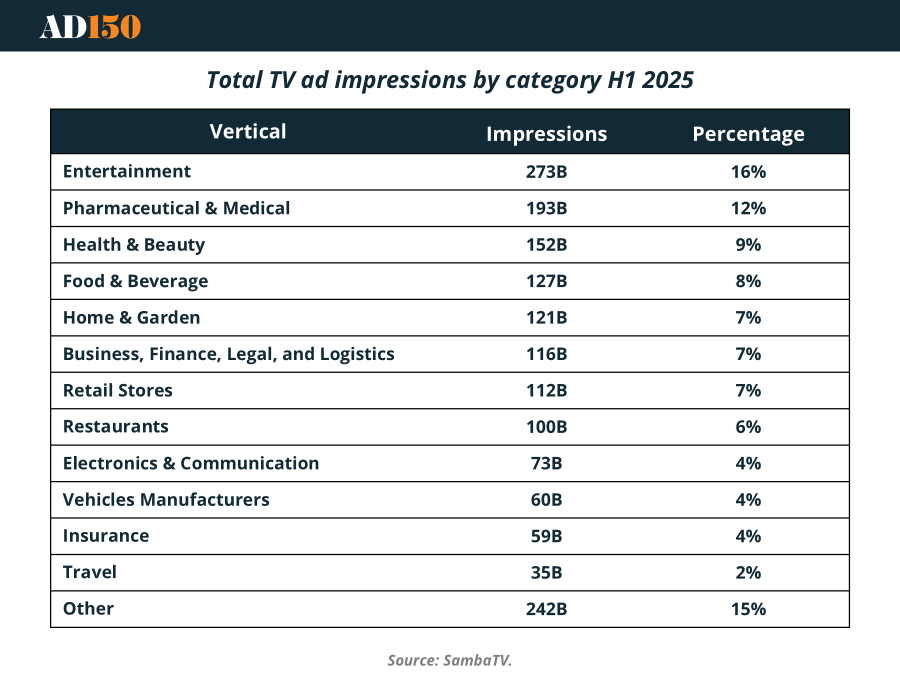

TV ad spend is consolidating around a few heavyweight verticals. In H1 2025, Entertainment (273B impressions, 16%) led the pack, reflecting streaming launches and blockbuster releases. Close behind, Pharmaceutical & Medical (193B, 12%) and Health & Beauty (152B, 9%) highlight TV’s enduring strength for consumer trust categories. Everyday staples like Food & Beverage (127B, 8%) and Home & Garden (121B, 7%) remain steady contributors, while Retail Stores (112B, 7%) and Restaurants (100B, 6%) signal continued reliance on mass-reach formats to drive foot traffic.

Notably, Travel (35B, 2%) lags as budgets stay cautious, and Vehicles (60B, 4%) trail historic norms. With 242B impressions (15%) falling into “Other,” fragmentation across niche categories continues to rise.

Takeaway: TV remains a high-impact channel for mass-market categories, but spend is narrowing around industries where trust, habit, and frequency matter most. (More)

THE FUNNEL REPORT

Personalized Marketing Drives Measurable Sales Growth

Marketers are increasingly recognizing the power of personalization in driving revenue. According to our latest survey, 96% of marketers reported that offering personalized experiences increases sales. Nearly half (44%) see a significant lift, while another 44% experience moderate growth, highlighting the tangible benefits of tailoring messaging and experiences to individual customers. Only 4% reported no impact, and just 8% noted a slight increase. This data underscores the importance of focusing on customer experience throughout the funnel. From targeted content to personalized outreach, companies that prioritize individualized experiences are not only improving engagement but also converting more leads into revenue, reinforcing personalization as a critical lever in modern marketing strategies. (More)

BUDGET SHIFTS

New Business Takes the Lead

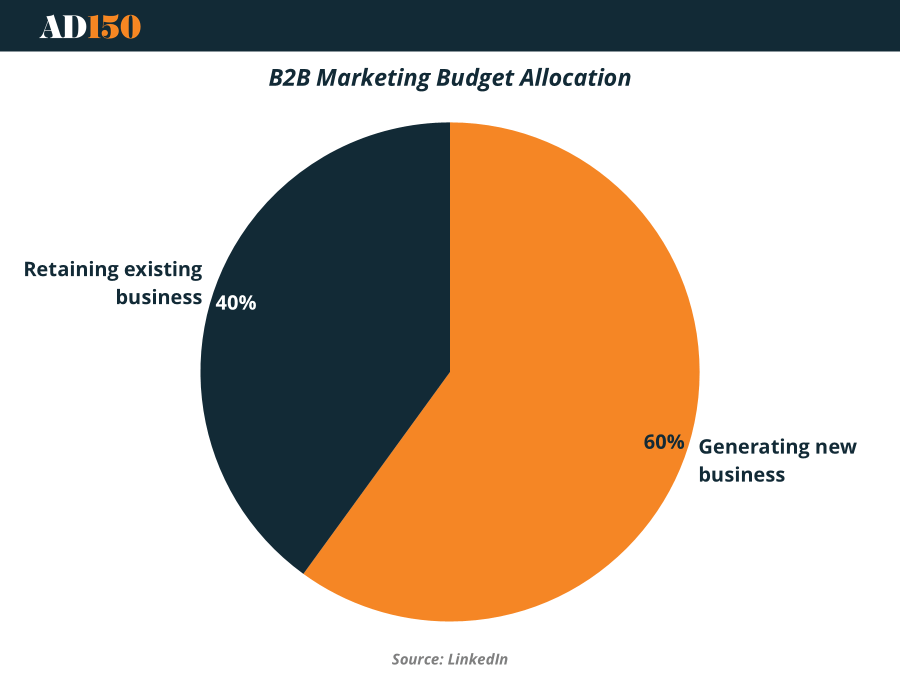

B2B organizations are reallocating marketing budgets toward growth, with a clear emphasis on acquiring new customers. According to recent data, 60% of B2B marketing budgets are now dedicated to generating new business, compared with 40% aimed at retaining existing clients. This shift reflects a broader trend: companies are prioritizing expansion and pipeline development over purely maintaining current accounts.

The survey also highlights that 7 in 10 respondents have increased budget allocation for lead generation, signaling a growing focus on demand creation. Meanwhile, 37% identify building a high-quality pipeline as their top priority for the year ahead, further emphasizing the strategic importance of new customer acquisition.

For advertisers and agencies, these trends underscore a strategic opportunity: campaigns and solutions that help B2B clients reach new prospects and accelerate pipeline velocity will likely receive greater funding and attention in 2025. (More)

BUYER’S ROOM

LinkedIn Emerges as the Non-Negotiable B2B Channel

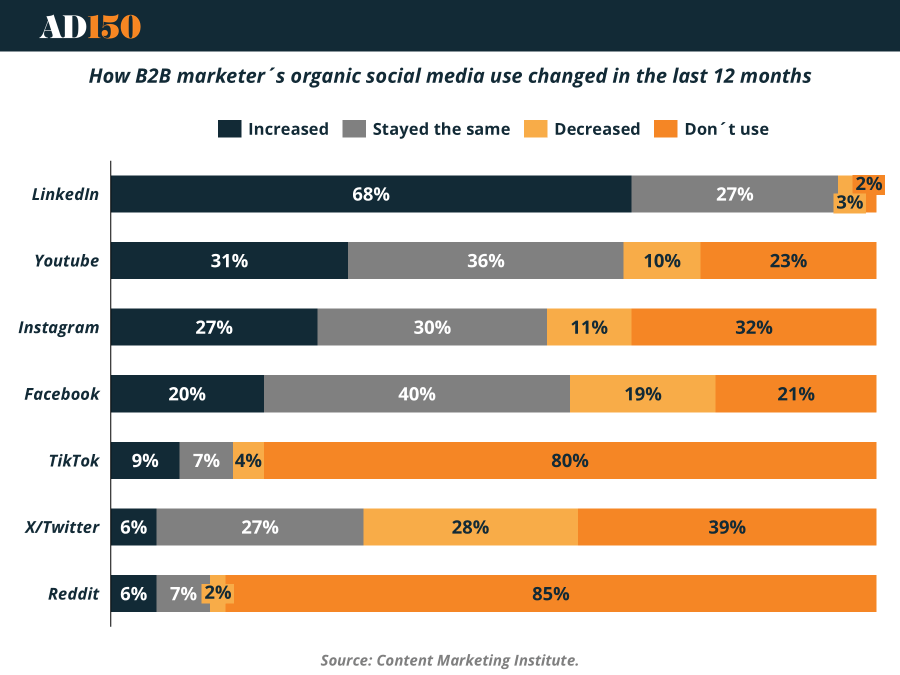

LinkedIn is cementing its role as the dominant B2B channel. Over the past 12 months, 68% of marketers increased their use of the platform, while another 27% held steady. By contrast, usage trends on other networks are more fragmented: YouTube and Instagram are balanced between moderate growth and plateau, Facebook shows signs of pullback with nearly 1 in 5 decreasing use, and X/Twitter remains polarized. Meanwhile, TikTok and Reddit are largely sidelined, with 80–85% of marketers reporting no use at all.

The takeaway: buyers are consolidating around LinkedIn as the reliable hub for lead generation and peer engagement, while other platforms remain either experimental or secondary plays. (More)

CREATIVE THAT CONVERTS

Turning Challenges into Conversions

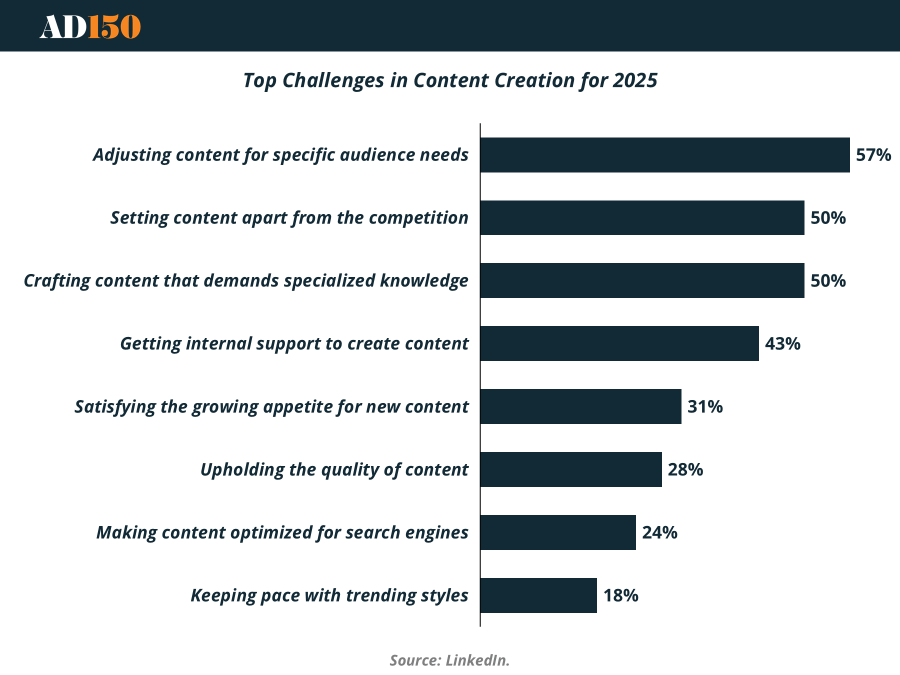

A recent survey highlights the top hurdles B2B marketers expect in 2025, with 57% citing the challenge of tailoring content to specific audience needs. Equally pressing are the struggles of setting content apart from competitors (50%) and producing content that requires deep subject-matter expertise (50%). These findings underline a critical truth: creative that converts is not just about attention—it’s about relevance.

For marketers, the implication is clear. Winning campaigns in 2025 will prioritize personalization at scale, blending creativity with specialized knowledge to cut through the noise. Teams that master this balance—delivering content that is both differentiated and credible—will be best positioned to capture audience engagement and drive measurable business impact. (More)

CASE STUDY

Slack’s Campaign: Reframing Productivity for the Enterprise Buyer

As growth slowed post-pandemic and competition from Microsoft Teams and Google Workspace intensified, Slack faced the challenge of reaffirming its role as more than just a messaging platform. The objective was clear: highlight Slack’s broader value proposition—integrations, automations, and enterprise-scale capabilities—while re-engaging business decision-makers.

To meet this challenge, Slack launched a storytelling-driven campaign that spotlighted how small teams within large organizations were achieving outsized productivity gains using Slack. The campaign unfolded through short films, customer testimonials, and mini-documentaries, all designed to make enterprise adoption feel both practical and aspirational. Hyper-targeted by sector, the content was delivered through curated YouTube playlists, sponsored placements on Twitter (X), and partnerships with business podcasts—meeting buyers where they already consumed professional content.

The impact was measurable and far-reaching:

41% increase in engagement rates on LinkedIn posts featuring customer stories

21% lift in enterprise product demo requests within three months

23% improvement in brand sentiment among IT buyers

5.2 million video views across YouTube and social platforms in Q2 2025

This campaign demonstrates how authentic business scenarios and user-generated storytelling can resonate in B2B markets. By celebrating small wins and tailoring content to specific industries, Slack was able to connect with enterprise buyers on both a practical and emotional level. The result: a clear repositioning of Slack as a productivity platform built for scale, not just chat. (More)

INTERESTING ARTICLES

"The secret of business is to know something that nobody else knows."

Aristotle Onassis